1.1 The formation of a core-periphery structure in heterogeneous financial networks

Daan in ’t Veld, Marco van der Leij, Cars Hommes

Keywords: Interbank markets; Core-periphery structure; Network formation models.

Author Daan in 't Veld on the article:

Economists claim to know everything about markets, but the headline battlefield in the financial crisis of 2007 and 2008 was virtually unknown: the interbank market. Financial problems in only a few financial institutions cascaded into a system-wide near-collapse. Economic losses amplified quickly, for a large part driven by exposure between banks that had been lending money to each other. The interbank market had been thought of as an efficient (uninteresting) risk-sharing arrangement, but we have learnt the hard way.

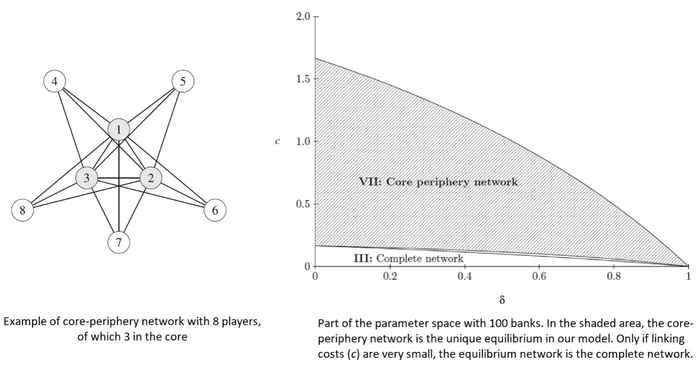

Most of the interbank transactions are ‘over-the-counter’, meaning that only the two banks involved in the loan are aware of its existence and size. That is the reason why the structure of transactions is difficult to picture. In the years following the financial crisis, interbank markets were discovered to exhibit a core-periphery network structure (see left side of Figure for a schematic example).

In our paper we propose an explanation of why banks form a core-periphery structure. We argue that banks profit from being in the core because of intermediation, that is, by bringing supply and demand of periphery banks together. To investigate which type of structures are likely to exist, their stability is investigated using common tools of network formation theory and dynamic analysis.

Surprisingly, if banks are homogeneous, the core periphery network is found to be unilaterally unstable, by which we mean that there is always an incentive for at least one bank to change the structure. A core-periphery network structure can form endogenously, however, if we allow for heterogeneity among banks in size. Moreover, size heterogeneity may arise endogenously if payoffs feed back into bank size. We show formally under which conditions the core periphery is (not) the equilibrium outcome (see right side of Figure for an illustration).

The paper helps understanding how regulation affects financial interrelations and, indirectly, how regulation can be improved. The core-periphery model has naturally been applied to many other areas in the social sciences. Different mechanisms may drive systems towards tiered, hierarchical structures; intermediation is one mechanism that is relevant for interbank markets. Yet we may more generally expect that formation models prove useful to see underlying causes for many phenomena characterised by individuals and mutual links.

In 't Veld, D., van der Leij, M. & Hommes, C. (2020). The formation of a core-periphery structure in heterogeneous financial networks. Journal of Economic Dynamics and Control, 199.